If you’re looking to navigate the world of foreign exchange trading, it’s essential to choose a reliable and efficient trading platform. With the rise of online trading, there are many options available, and it’s crucial to find one that meets your needs. In this article, we will explore some of the best forex trading platforms available today, focusing on their features, advantages, and what makes them stand out in a crowded market. One of the options worth considering is good forex trading platforms Trading Broker JO, known for its robust offerings.

Understanding Forex Trading Platforms

A forex trading platform is a software application that allows traders to buy and sell currencies in the foreign exchange market. These platforms provide the tools necessary for traders to execute trades, analyze market trends, and manage their accounts. They come in various forms, including web-based platforms, desktop applications, and mobile apps. Understanding the functionalities and features of these platforms is key to maximizing your trading potential.

Key Features of Good Forex Trading Platforms

When evaluating different forex trading platforms, several key features should be considered:

- User Interface: A user-friendly interface is essential for both novice and experienced traders. The platform should allow easy navigation and quick access to trading tools and information.

- Currency Pairs: The best platforms offer a wide range of currency pairs for trading, including major, minor, and exotic pairs, allowing traders to diversify their portfolios.

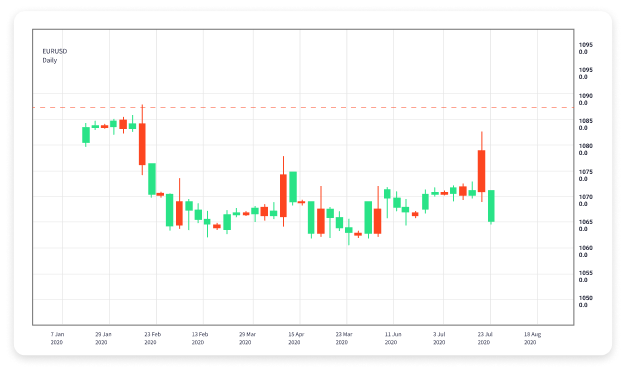

- Charting Tools: Advanced charting tools and technical analysis indicators are vital for making informed trading decisions. Look for platforms that offer customizable charts and a variety of analytical tools.

- Order Types: Good platforms should support different types of orders, such as market orders, limit orders, and stop-loss orders, giving traders flexibility in executing their strategies.

- Mobile Compatibility: In today’s fast-paced market, having a mobile-friendly platform is a necessity. Traders should be able to execute trades and monitor the market from their smartphones or tablets.

- Customer Support: Reliable customer support is crucial, especially for traders who may need assistance in navigating the platform or resolving technical issues.

- Security: A good forex trading platform should prioritize security measures, such as encryption and two-factor authentication, to protect traders’ information and funds.

Top Forex Trading Platforms

1. MetaTrader 4 (MT4)

MetaTrader 4 is perhaps the most popular forex trading platform worldwide. It is well-known for its user-friendly interface, advanced charting tools, and extensive range of technical indicators. MT4 supports automated trading through Expert Advisors (EAs), enabling traders to set specific trading strategies and execute trades automatically. Furthermore, it provides access to a vast community of traders where strategies and tips are shared.

2. MetaTrader 5 (MT5)

MetaTrader 5 is the successor to MT4 and offers enhancements in speed and versatility. It not only supports forex trading but also provides access to stock, commodities, and options trading. MT5 has additional features like more timeframes, improved charting tools, and a built-in economic calendar, making it a favorite among advanced traders.

3. cTrader

cTrader is gaining popularity among forex traders for its intuitive interface and advanced trading capabilities. It offers an array of features such as one-click trading, advanced order types, and deep liquidity. Additionally, cTrader provides exceptional charting tools and technical analysis features that many forex traders value.

4. TradingView

While primarily known as a charting platform, TradingView also offers trading functionalities with integrated brokers. Its social networking aspect allows traders to share their insights and strategies, fostering a community of collaboration and learning. TradingView’s extensive library of technical indicators and customizable charts makes it ideal for both beginner and advanced traders.

5. NinjaTrader

NinjaTrader is a platform beloved by futures and forex traders alike. It provides advanced charting, backtesting capabilities, and a wide range of research resources. The platform’s market analysis tools and ability to develop custom strategies are features that attract serious traders who rely on market data and analysis to make their trading decisions.

Choosing the Right Forex Trading Platform

With so many options available, selecting the right forex trading platform can be overwhelming. Here are some tips to help you make your decision:

- Define Your Trading Style: Consider what type of trader you are—scalper, day trader, or swing trader—and choose a platform that aligns with your trading style.

- Test Before Committing: Many platforms offer demo accounts. Utilize these accounts to explore the platform’s features and functionalities without risking real money.

- Compare Fees and Costs: Analyze the fee structures of different platforms, including spreads, commissions, and withdrawal fees, to ensure you choose one that fits your budget.

- Seek Recommendations: Read reviews, ask for recommendations from experienced traders, and research community forums to gather insights about various platforms.

Conclusion

Choosing the right forex trading platform can significantly influence your trading success. With the growing number of options available, it’s essential to do thorough research, understand your trading needs, and test out different platforms before making a decision. Remember that a good trading platform should cater not only to your current needs but also to your future trading aspirations.