Liabilities are items or money the company owes, such as mortgages, loans, etc. For the remainder of the forecast, the short-term debt will grow by $2m each year, while the long-term debt will grow by $5m. Lenders and investors perceive borrowers funded primarily with equity (e.g. owners’ equity, outside equity raised, retained earnings) more favorably. For example, Company A has quick assets of $20,000 and current liabilities of $18,000. If the D/E ratio gets too high, managers may issue more equity or buy back some of the outstanding debt to reduce the ratio. Conversely, if the D/E ratio is too low, managers may issue more debt or repurchase equity to increase the ratio.

Related Terms

By contrast, higher D/E ratios imply the company’s operations depend more on debt capital – which means creditors have greater claims on the assets of the company in a liquidation scenario. Lenders and debt investors prefer lower D/E ratios as that implies there is less reliance on debt financing to fund operations – i.e. working capital requirements such as the purchase accounting software: email settings in xero of inventory. The D/E ratio also gives analysts and investors an idea of how much risk a company is taking on by using debt to finance its operations and growth. When it comes to choosing whether to finance operations via debt or equity, there are various tradeoffs businesses must make, and managers will choose between the two to achieve the optimal capital structure.

What is considered a bad debt-to-equity ratio?

Over time, the cost of debt financing is usually lower than the cost of equity financing. This is because when a company takes out a loan, it only has to pay back the principal plus interest. Taking a broader view of a company and understanding the industry its in and how it operates can help to correctly interpret its D/E ratio. For example, utility companies might be required to use leverage to purchase costly assets to maintain business operations.

Investor Services

However, it could also mean the company issued shareholders significant dividends. While not a regular occurrence, it is possible for a company to have a negative D/E ratio, which means the company’s shareholders’ equity balance has turned negative. If a company’s D/E ratio is too high, it may be considered a high-risk investment because the company will have to use more of its future earnings to pay off its debts. This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used. Interest payments on debt are tax-deductible, which means that the company can reduce its taxable income by deducting the interest expense from its operating income.

What Is Leverage?

- For the remainder of the forecast, the short-term debt will grow by $2m each year, while the long-term debt will grow by $5m.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- Assume a company has $100,000 of bank lines of credit and a $500,000 mortgage on its property.

As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply. High leverage ratios in slow-growth industries with stable income represent an efficient use of capital. Companies in the consumer staples sector tend to have high D/E ratios for similar reasons. Short-term debt also increases a company’s leverage, of course, but because these liabilities must be paid in a year or less, they aren’t as risky.

This could lead to financial difficulties if the company’s earnings start to decline especially because it has less equity to cushion the blow. Generally, a D/E ratio of more than 1.0 suggests that a company has more debt than assets, while a D/E ratio of less than 1.0 means that a company has more assets than debt. The principal payment and interest expense are also fixed and known, supposing that the loan is paid back at a consistent rate. It enables accurate forecasting, which allows easier budgeting and financial planning.

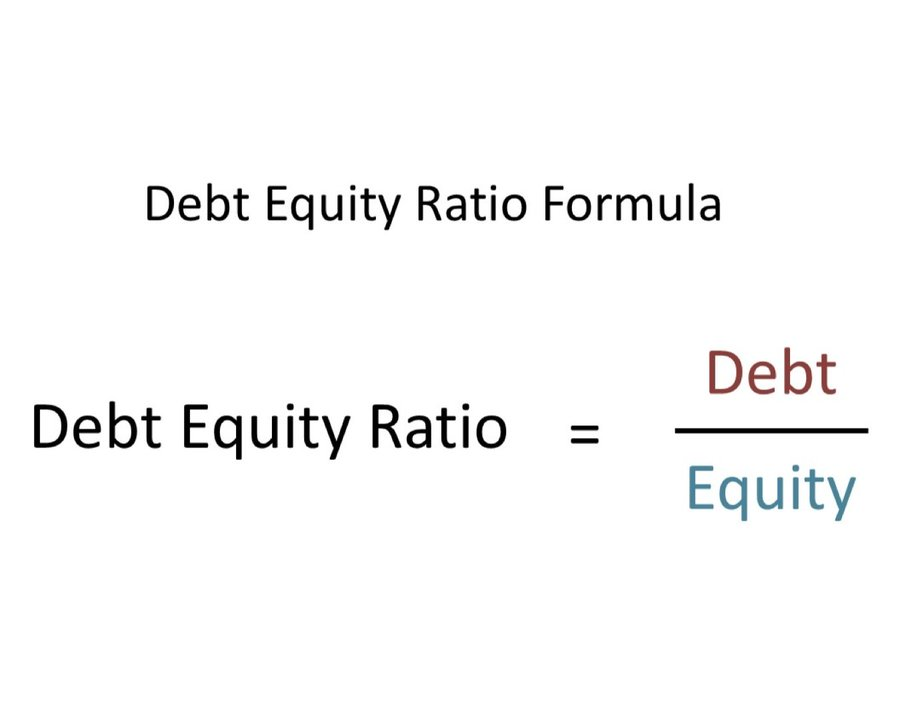

The weighted average cost of capital (WACC) can provide insight into the variability of a company’s D/E ratio. The WACC shows the amount of interest financing on the average per dollar of capital. You can calculate the debt-to-equity ratio by dividing shareholders’ equity by total debt. For example, if a company’s total debt is $20 million and its shareholders’ equity is $100 million, then the debt-to-equity ratio is 0.2.

In most cases, this would be considered a sign of high risk and an incentive to seek bankruptcy protection. What counts as a “good” debt-to-equity (D/E) ratio will depend on the nature of the business and its industry. Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky. Companies in some industries, such as utilities, consumer staples, and banking, typically have relatively high D/E ratios. We can see below that for Q1 2024, ending Dec. 30, 2023, Apple had total liabilities of $279 billion and total shareholders’ equity of $74 billion.

Whether the ratio is high or low is not the bottom line of whether one should invest in a company. A deeper dive into a company’s financial structure can paint a fuller picture. Many startups make high use of leverage to grow, and even plan to use the proceeds of an initial public offering, or IPO, to pay down their debt. The results of their IPO will determine their debt-to-equity ratio, as investors put a value on the company’s equity. If earnings don’t outpace the debt’s cost, then shareholders may lose and stock prices may fall. For example, if a company takes on a lot of debt and then grows very quickly, its earnings could rise quickly as well.

For example, if a company, such as a manufacturer, requires a lot of capital to operate, it may need to take on a lot of debt to finance its operations. The term “leverage” reflects the hope that the company will be able to use a relatively small amount of debt to boost its growth and earnings. Wise use of debt can help companies build a good reputation with creditors, which, in turn, will allow them to borrow more money for potential future growth. Companies also use debt, also known as leverage, to help them accomplish business goals and finance operating costs. Calculating a company’s debt-to-income ratio requires a relatively simple formula investors can use on their own or with a spreadsheet. The debt-to-equity ratio (D/E) is one of many financial metrics that helps investors determine potential risks when looking to invest in certain stocks.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The cash ratio is a useful indicator of the value of the firm under a worst-case scenario. Aside from that, they need to allocate capital expenditures for upgrades, maintenance, and expansion of service areas. Another example is Wayflyer, an Irish-based fintech, which was financed with $300 million by J.P.