Is Pocket Option Legal in India?

The question of whether is pocket option legal in india is pocket option legal in india is prevalent among traders seeking to explore opportunities in online trading platforms. Pocket Option has emerged as a popular binary options trading platform, enabling users to trade various assets easily. However, the legality of such platforms in India is a complex issue, given the country’s regulations surrounding online gambling, trading, and investment.

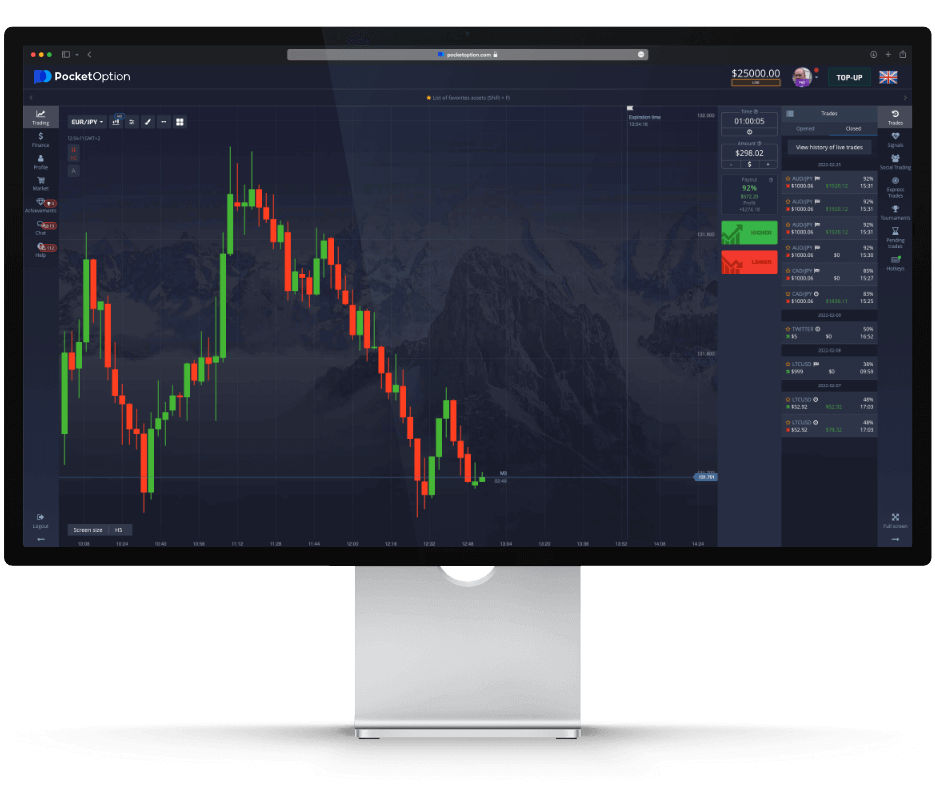

Before delving into the nuances of legality, it is essential to understand what Pocket Option offers. Launched in 2017, Pocket Option provides a user-friendly trading interface where traders can engage in binary options trading, including forex, cryptocurrencies, stocks, and commodities. Its global reach has made it an attractive option for many traders looking for a straightforward entry into the financial markets.

In India, the legality of online trading platforms like Pocket Option arises from the definitions set forth by the country’s regulatory bodies. The Securities and Exchange Board of India (SEBI) is the principal authority regulating financial markets and investment avenues. SEBI’s guidelines primarily focus on protecting investor interests and ensuring fair trading practices, yet they do not have a clear stance on the legality of binary options trading.

Understanding Binary Options Trading in India

Binary options trading is a form of options trading where the payoff is either a fixed monetary amount or nothing at all. This makes it attractive to many traders due to its simplicity and the potential for quick profits. However, the regulatory environment in India is still evolving, with some experts likening binary options more to gambling than traditional investment methods.

In India, gambling laws vary from state to state, and the majority of states prohibit online gambling. The Public Gambling Act of 1867 governs gambling in India, leaving little room for the acceptance of online platforms offering binary options or gambling-like activities. Thus, if one considers the binary options trading model employed by Pocket Option, it could fall under the category of illegal activities according to Indian laws.

The Role of SEBI and Other Regulatory Bodies

While SEBI has not explicitly banned binary options trading, it has issued warnings against unregulated entities that offer such services. Many of these platforms operate outside of Indian jurisdiction, making it challenging for the authorities to enforce legal actions against them. This creates a grey area where traders must exercise caution, recognizing the risks posed by unregulated entities.

Moreover, some financial institutions and experts advise against engaging with such platforms due to the high potential for fraud and scams associated with unregulated trading. The absence of a well-defined regulatory framework governing binary options trading can make refunding funds or seeking recourse in case of disputes quite difficult. It is vital for prospective traders to conduct thorough research and seek regulated alternatives to ensure their investments’ safety.

Compliance and Registration of Trading Platforms

Some traders might wonder how platforms like Pocket Option operate legally in other countries while facing regulatory scrutiny in India. The answer often lies in these platforms being registered in offshore jurisdictions. For instance, Pocket Option is registered in the Republic of Seychelles, which possesses less stringent regulations around binary options trading. This makes it appealing for traders seeking freedom in trading but might expose them to higher risks when dealing with international entities.

In India, regulated entities like stock exchanges provide a safer avenue with greater investor protection. The Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) offer a variety of financial instruments, including options and futures, governed by strict regulatory guidelines. Engaging with such regulated platforms can mitigate risks associated with unregulated binary options trading.

Risks and Challenges of Trading on Platforms like Pocket Option

Trading on platforms such as Pocket Option exposes users to several risks, particularly given the uncertain legal landscape. One of the primary concerns is the potential for losses due to market volatility and the high-risk nature of binary options trading. The allure of quick profits can cloud judgment, leading traders to make unwise decisions without understanding the underlying risks.

Additionally, the possibility of fraud cannot be dismissed. Many traders have reported issues with fund withdrawals and customer service on unregulated platforms. As a fledgling trader, it is crucial to remain aware of such concerns and prioritize personal financial safety above the desire for profits.

Conclusion: Is Pocket Option Worth It in India?

Ultimately, the question of whether the platform is legal in India hinges on its classification under the existing regulations, and traders should tread carefully. While Pocket Option may offer appealing features, the regulatory ambiguities surrounding binary options trading make it imperative for individuals to consider their financial safety seriously. Seeking advice from financial professionals and utilizing regulated trading platforms may provide greater peace of mind and a more secure trading environment.

In summary, although platforms like Pocket Option thrive in a global market, prospective traders in India should weigh the risks and legality of engaging with such services. Understanding the local legal landscape and opting for regulated trading avenues could ultimately lead to a more secure trading experience.